EVIDENCE-BASED INVESTING EVERYONE CAN UNDERSTAND

While 99% of traders fail, we are in the succeeding 1%

Learn from third party verified traders, who share every order in real time. Receive e-mails with insight into decision making and trade execution.

Meet us

OVER 20 YEARS COMBINED STOCK TRADING EXPERIENCE

Alexander Mendelson

Experienced Traders

Each of us has over 10 years of experience in the financial markets. We are personally invested in stocks that we inform you about, before investing. We have an academic background in Business Economics and several years of working experience in the financial industry. Our mission: To make trading transparent, easy to learn and profitable. We want to help ensure everyone achieves sustainable and profitable growth by investing in the right stocks at the right time.

Vitalij Lukowitsch

Experienced Traders

We have over 10 years of experience in the financial markets. We are personally invested in stocks that we inform you about, before investing. We have an academic background in Business Economics and several years of working experience in the financial industry. Our mission: To make trading transparent, easy to learn and profitable. We want to help ensure everyone achieves sustainable and profitable growth by investing in the right stocks at the right time.Our Investment Philosophy

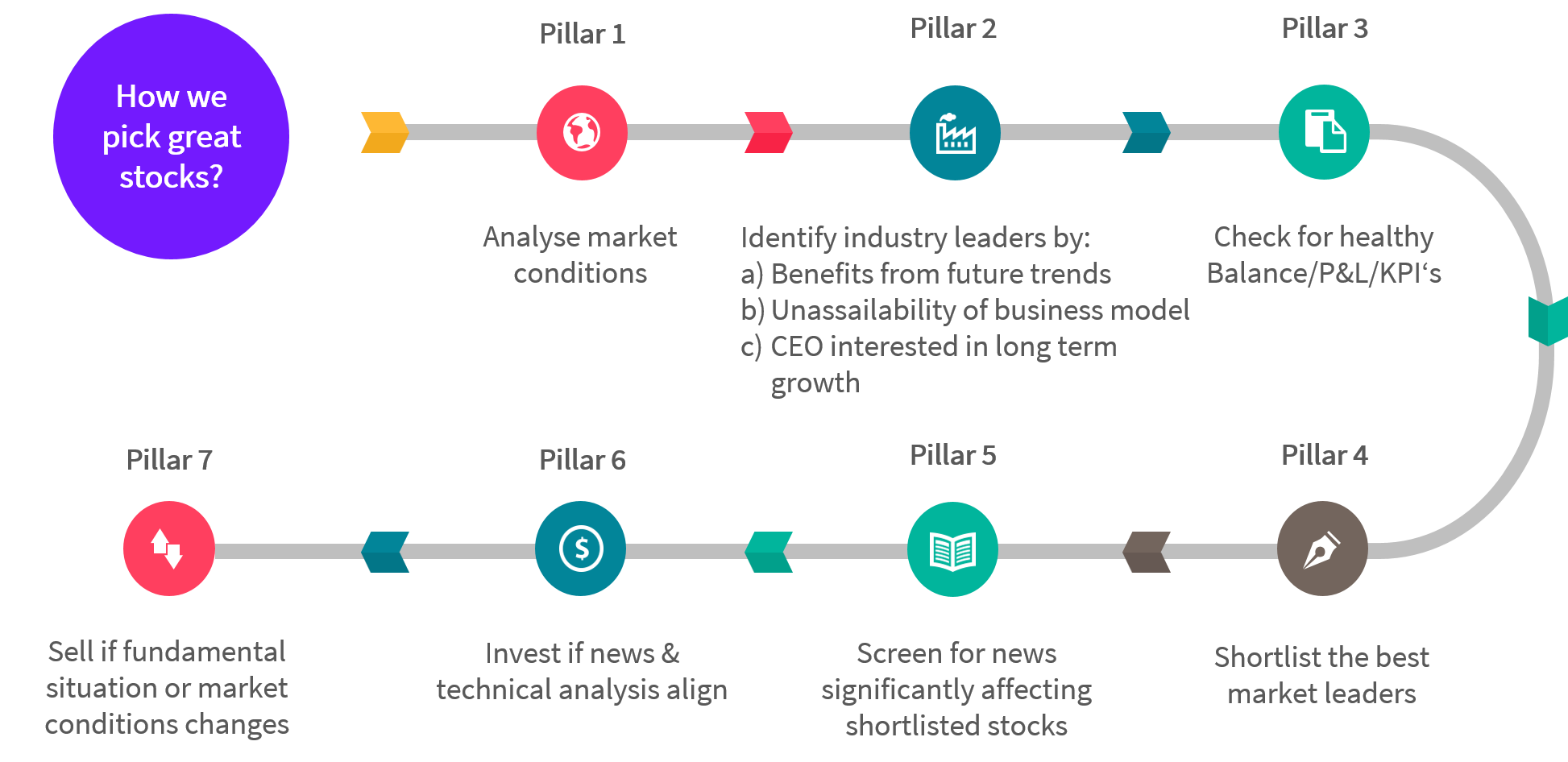

WE BASE OUR INVESTMENT PHILOSOPHY ON 7 PILLARS

Investment Summary

We analyze general market conditions and categorize industry sector leaders by: 1.) Potential benefits from future trends e.g. AI, Platforms, Big Data, eMobility, etc.; 2.) An unassailable- and disruptive business model.; 3.) A CEO interested in long term company growth rather than his own gains.; We are screening the market for news with a huge impact on our selected value stocks and as soon as the news enacts a sustainable growth trend in regard to technical analysis we invest in the selected stock. We sell, if the fundamental situation of a particular stock changes or the macro perspective deteriorates.

Qualitative Value Investment

We interpret value investing in the tradition of Warren Buffett, Philip Fisher and Charlie Munger. Value is equated to affordable quality. Companies are assessed on the basis of their long-term competitive, unfair advantage and their unassailability. Warren Buffett refers to companies with significant competitive advantages as economic moat. They consistently dominate their competition with stable and high growth rates.Additionally, their financials and balance are always healthy. We invest in their stocks and leave them in our portfolio for the long run. This is the only way to let the compound interest play its magic. We love high dividend stocks and family businesses lead by a competent management.

Investment in Disruptive Technology

The concept of disruptive innovation was established by Joseph Schumpeter. When Apple launched the iPhone (innovation) it led to the downfall (disruption) of the previous market leader Nokia. We look for companies that establish such dynamic changes in the social and economic environment.Technology leaders who exploit new markets and industries can multiply their share values. Hence, it is critical to identify future trends and associated companies and buy stocks if the technical analysis supports the upward trend.

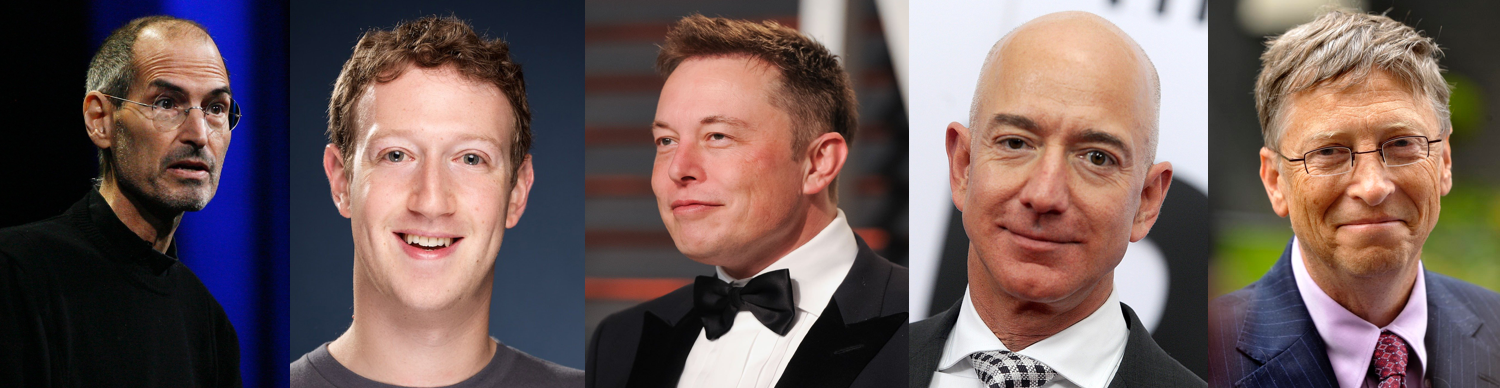

Investments in exceptional leaders & CEO’s

Like in sports, we believe there are exceptional people in business who can significantly change our reality and create new industries. CEOs like Elon Musk or Jeff Bezos consistently demonstrate their ability to transform their vision into reality. We believe it is reasonable to invest in companies that are steered by exceptional and visionary leaders.

News Trading using Pivotal News Points

The market is rarely random. Big moves or trends over weeks and months are often triggered by fundamental changes – This is a pivotal point. Finding a pivotal point is key and generates an excellent risk-reward profile without waiting too long until the price action starts.

Technical Analysis

We use technical analysis in combination with pivotal points as the chart can help us to find the right timing. Technical Analysis or the chart alone are separately worthless without a fundamental trigger. Several results are expected when using 100 technical analysts to forecast an asset. Only when the chart is put into the news context does it sense. We use technical analysis: To identify trend structures and breakout scenarios In combination with moving averages and the 52-week high

Macro Perspective

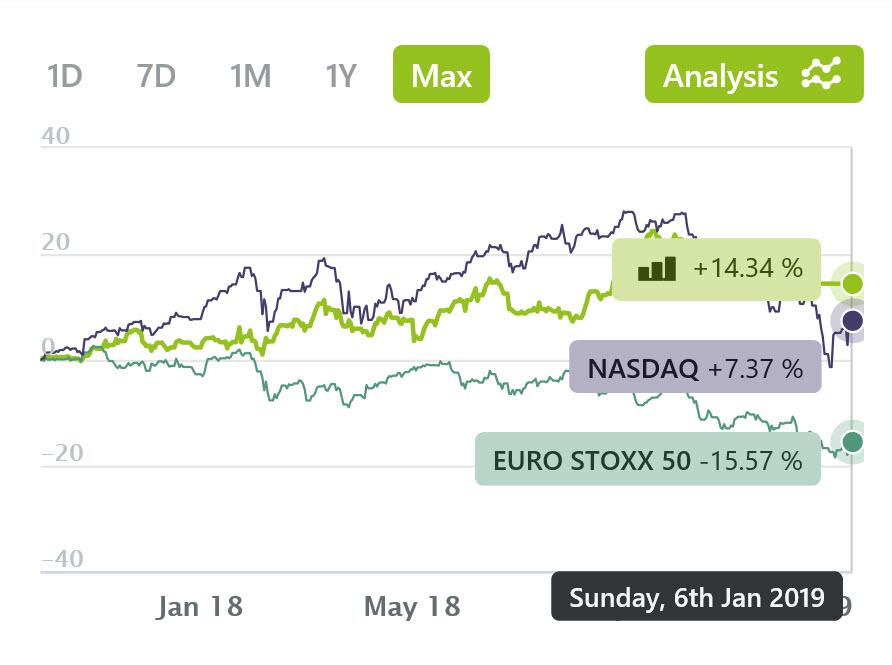

We observe the general stock market as well as the macroeconomic situation. Following change indicators in the market, we adjust our portfolios accordingly. This means, building up a better cash position if the market is overheated or buying stocks in fear- or correction phases. Comparing a particular stock with the index is more important than observing general market conditions. We search for stocks with the highest margins as well as those from industry leaders, and compare their strength to the total market. Meaning, if we buy a stock, it has to be stronger than the index otherwise we would be theoretically be better off buying index directly. Lastly, if the market is falling but our stock is rising it gives a clear indication of it being a top candidate.

Risk Management Strategy

We sell, if the fundamental situation of a particular stock changes or the macro perspective deteriorates.

We’ll turn you into a winner

IT'S TIME YOU TURNED YOUR STOCK TRADING AROUND.

VESTQ.com has helped 600 traders since 2017

If I hadn’t found this site, I’d probably be still losing money. I was never able to manage risk like that, always taking too long to sell. It’s just a complete new philosophy for me to combine news trading with value analysis. Thank you guys!

I’ve been able to find good stocks before. But most of the times I sold either too early or too late. Now I learned how to evaluate the macro so I avoid big drawdowns. Never seen anything like that in stock market education before.

This is a whole new level of trading. I learned how to manage a portfolio and how to determine superior stocks in particular growth sectors. Now I can use that experience and my track record to work for funds or portfolio managers.

Make a full-time or passive income from Stock Trading now.

WE'RE HERE TO HELP YOU TRADE THE STOCK MARKET PROFITABLY. JOIN US NOW AND FAST TRACK TO PROFESSIONAL TRADING.